Governor Andrew M. Cuomo has proposed legislation to waive taxes on grants from the $800 million COVID-19 Pandemic Small Business Recovery Grant Program. Applications for the program will be accepted starting June 10 for small and micro businesses and small for-profit independent arts and cultural organizations to help them recover from the economic impact of the pandemic.

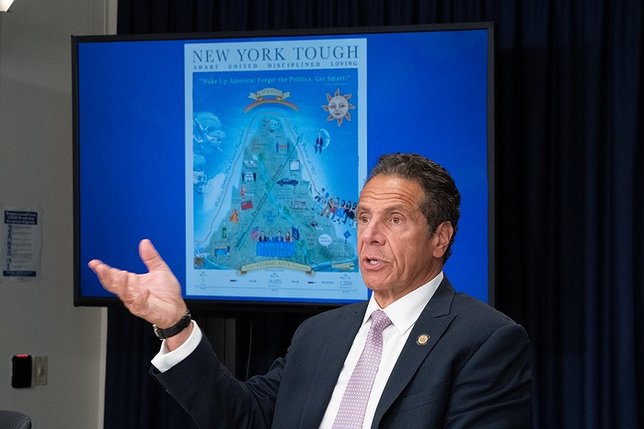

"Small businesses have long been the backbone of New York State's economy but were devastated by the COVID-19 pandemic, and it was critically important that the state stepped up to help this critical sector," Governor Cuomo said. "We want to make sure all $800 million of the COVID-19 Pandemic Small Business Recovery Grant Program is available to help grantees, and this legislation will eliminate state taxes on that funding so we can get every single dollar into the pockets of businesses and help rebuild New York's economy for the future."

Flexible grants up to $50,000 will be made available to eligible small businesses and can be used for operating expenses, including payroll, rent or mortgage payments, taxes, utilities, personal protective equipment, or other business expenses incurred during the pandemic. Over 330,000 small and micro businesses are potentially eligible for this program, including 57 percent of the State's certified MWBEs.

Small Business Recovery Grant Program

The small business recovery grant program will provide funding to small and micro businesses and small for-profit independent arts and cultural organizations to help them recover from the economic impact of the pandemic, with priority being given to socially and economically disadvantaged business owners, including minority- and women-owned business enterprises, service-disabled veteran-owned businesses and veteran-owned businesses, and businesses located in economically distressed communities.

Grants will be for a minimum award of $5,000 and a maximum award of $50,000 and will be calculated based on a New York State business' annual gross receipts for 2019. Reimbursable COVID-19 related expenses must have been incurred between March 1, 2020 and April 1, 2021 and can include:

- Payroll costs

- Commercial rent or mortgage payments for NYS-based property

- Payment of local property or school taxes

- Insurance costs

- Utility costs

- Costs of personal protection equipment necessary to protect worker and consumer health and safety

- Heating, ventilation, and air conditioning costs

- Other machinery or equipment costs

- Supplies and materials necessary for compliance with COVID-19 health and safety protocols